Montana’s nonprofit sector is at a pivotal moment. Despite economic challenges, the sector continues to grow, both in the number of organizations and in overall employment. However, workforce retention, housing costs, and shifts in charitable giving present hurdles that require strategic responses. The “Nonprofits by the Numbers 2025” presentation hosted by the Montana Nonprofit Association (MNA) provided an in-depth analysis of these trends, offering insights and data to help organizations navigate the road ahead.

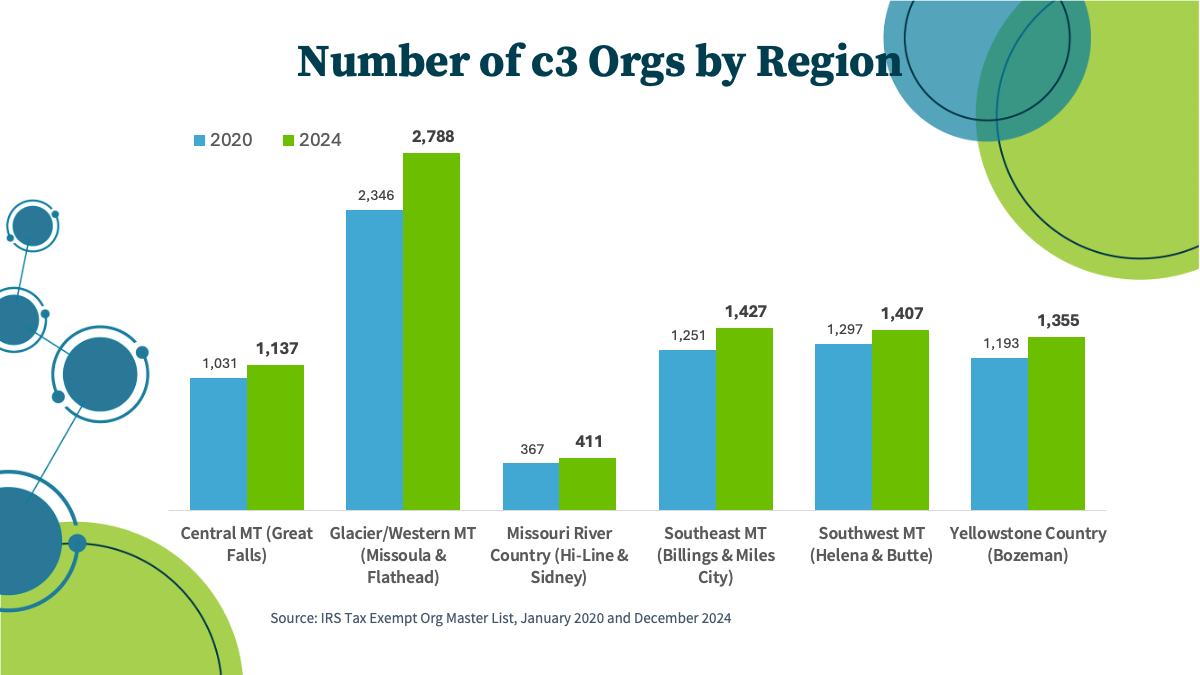

One of the most significant takeaways is that the nonprofit sector in Montana is expanding. According to IRS data, Montana has seen an increase of nearly 1,000 new 501(c)(3) organizations since 2020, bringing the total to over 8,500. This growth is particularly concentrated in high-population areas like Gallatin, Flathead, Ravalli, Yellowstone, and Missoula Counties.

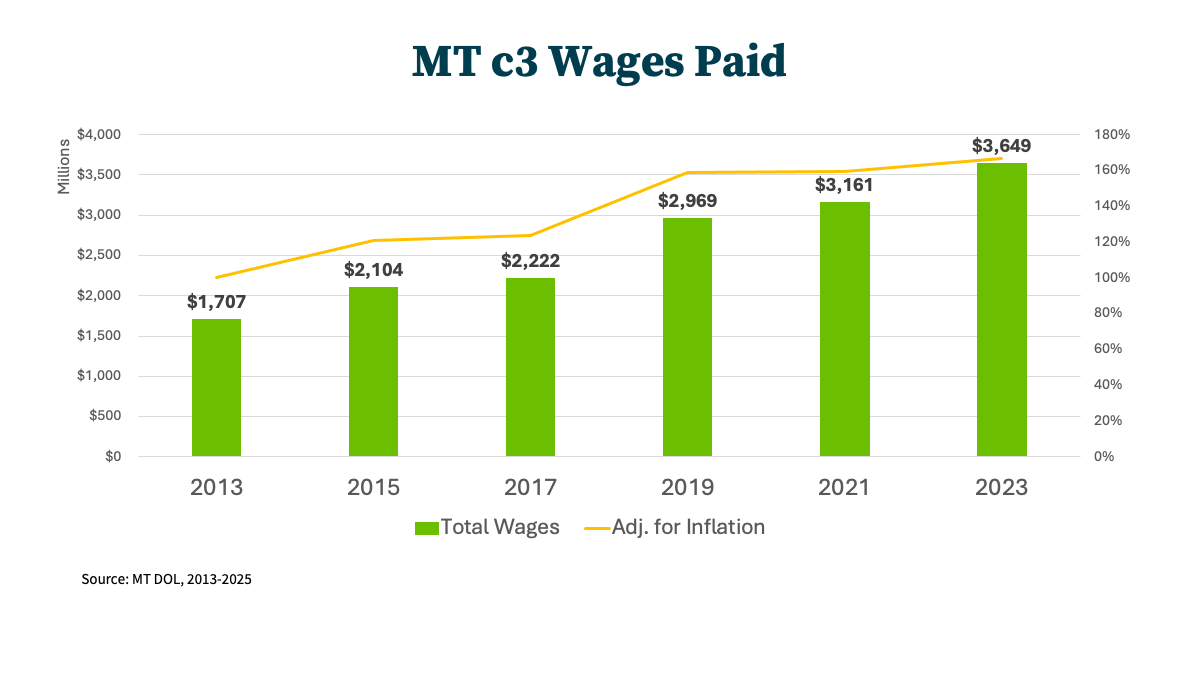

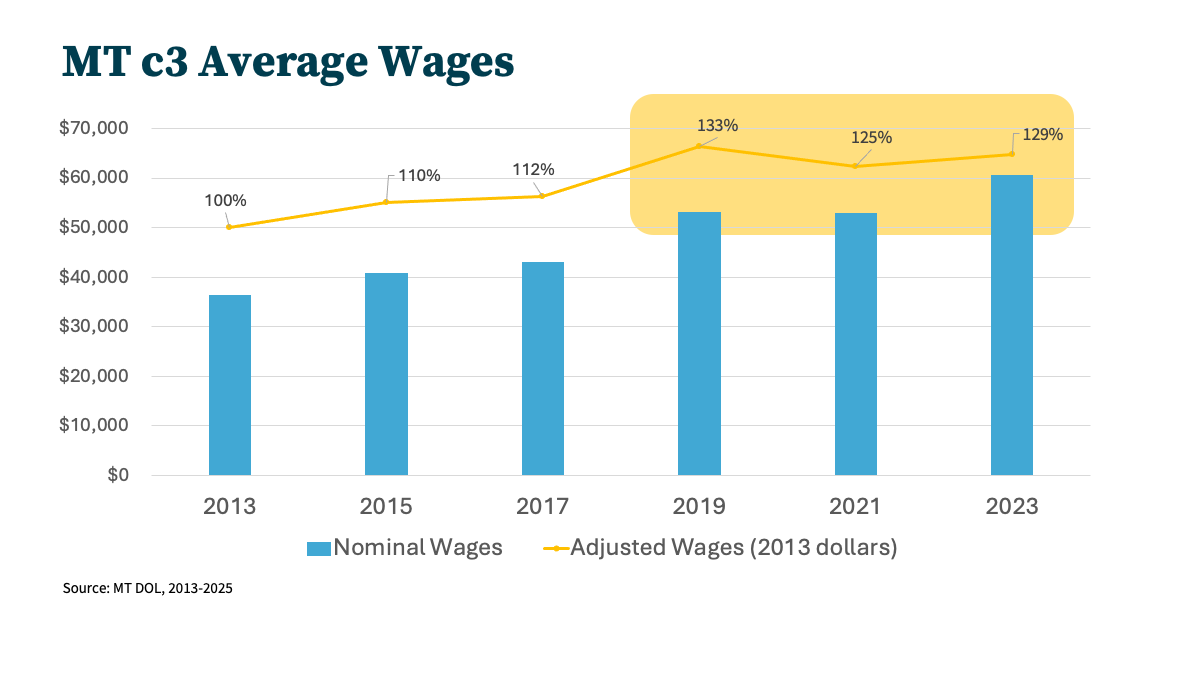

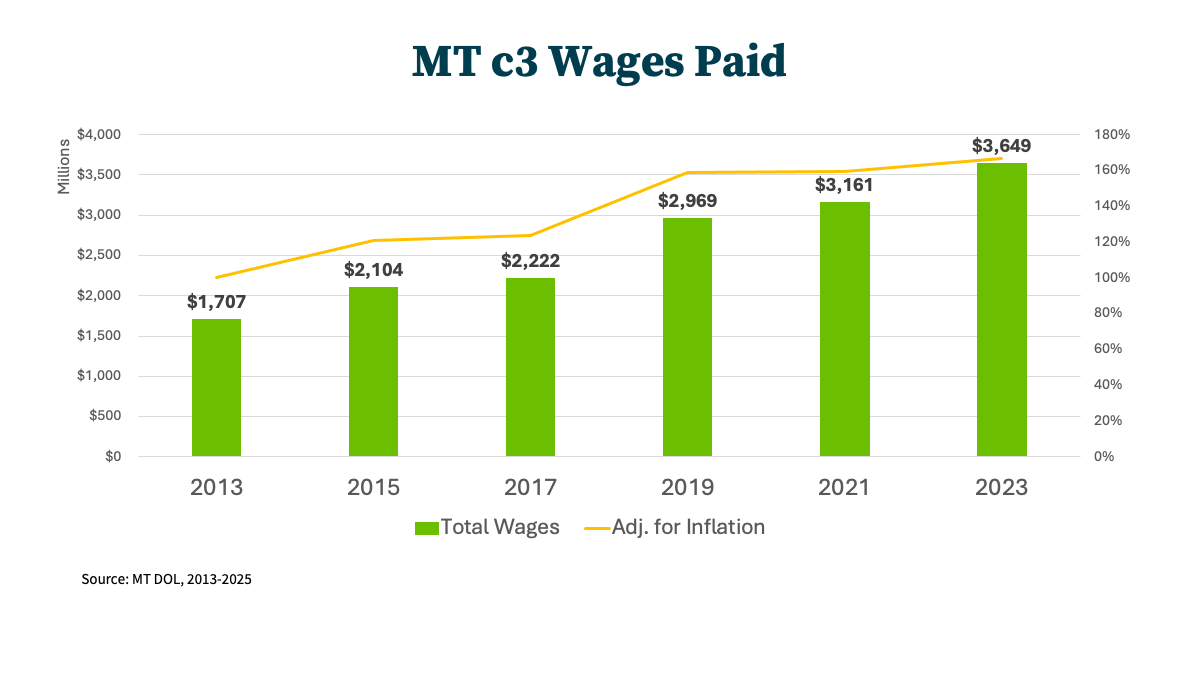

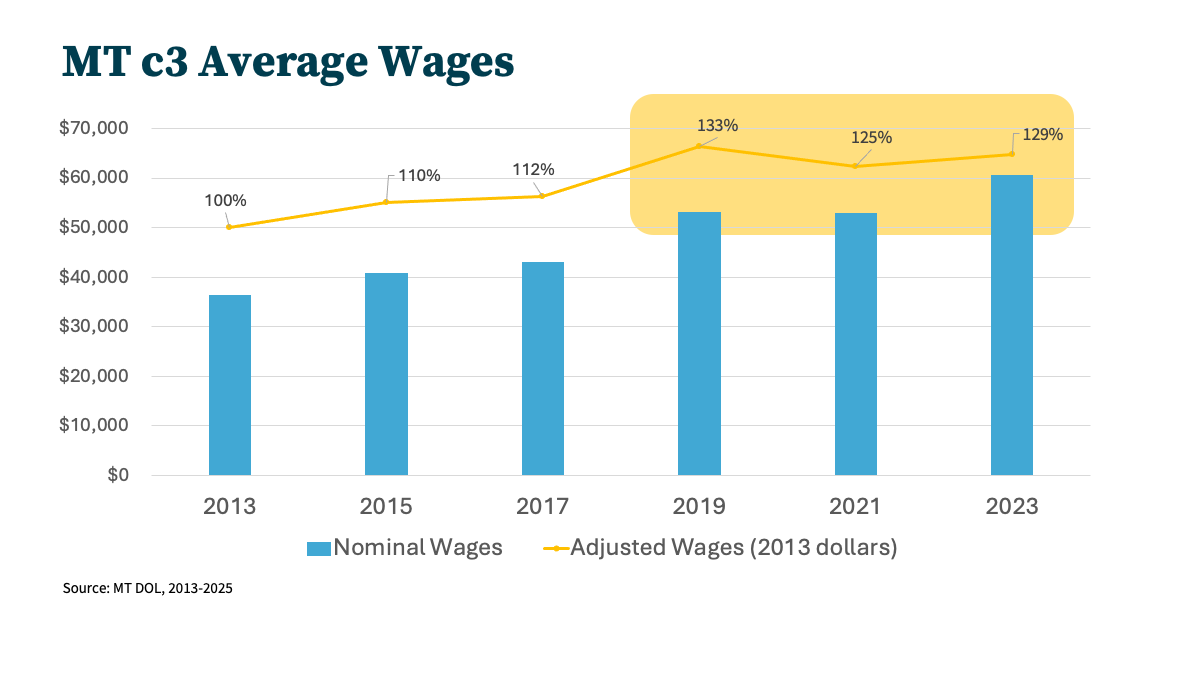

The nonprofit sector is a major economic driver in Montana. With over 60,000 employees, it represents more than 10% of the state’s workforce. Nonprofits paid out approximately $3.6 billion in wages in 2023, underscoring their role in Montana’s economy. However, inflation has significantly impacted wage increases, reducing their real value. Although salaries have risen, their purchasing power peaked in 2019 and has declined since then due to rising costs.

One of the biggest challenges for Montana nonprofits is workforce retention, largely due to the rising cost of living. Housing costs have nearly doubled since 2019, making Montana the least affordable state in the U.S. according to the National Association of Realtors. The median home sale price in the state has increased by 98% over the past five years, making homeownership increasingly out of reach for nonprofit employees.

In response to hiring difficulties, 84% of nonprofits have increased wages, yet 27% of organizations report having positions they are unable to fill. Additionally, 51% of nonprofits do not have a formal compensation policy, which can contribute to wage inequities and retention struggles. To address these challenges, nonprofits are exploring flexible work schedules, improved benefits, and competitive salaries to attract and retain talent.

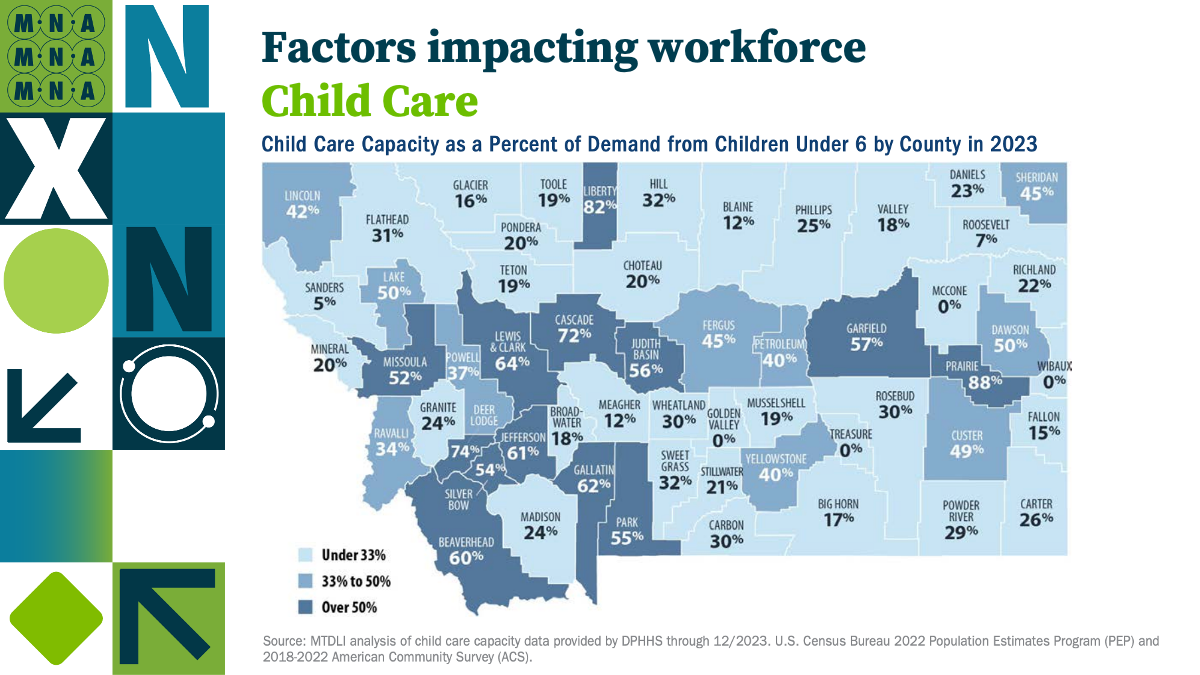

Limited childcare availability is another factor affecting workforce stability. Many counties lack licensed childcare facilities, forcing working parents to rely on informal arrangements. Although the state saw an 8% increase in childcare slots in 2023, creating over 1,500 new openings, demand still far exceeds supply, limiting the ability of parents to remain in the workforce.

Charitable giving remains relatively flat, but when adjusted for inflation, nonprofits have experienced a 10.5% decline in real donation value since 2021. While high-net-worth individuals continue to donate, fewer middle-class donors are contributing at previous levels. This trend has significant implications for nonprofit funding strategies.

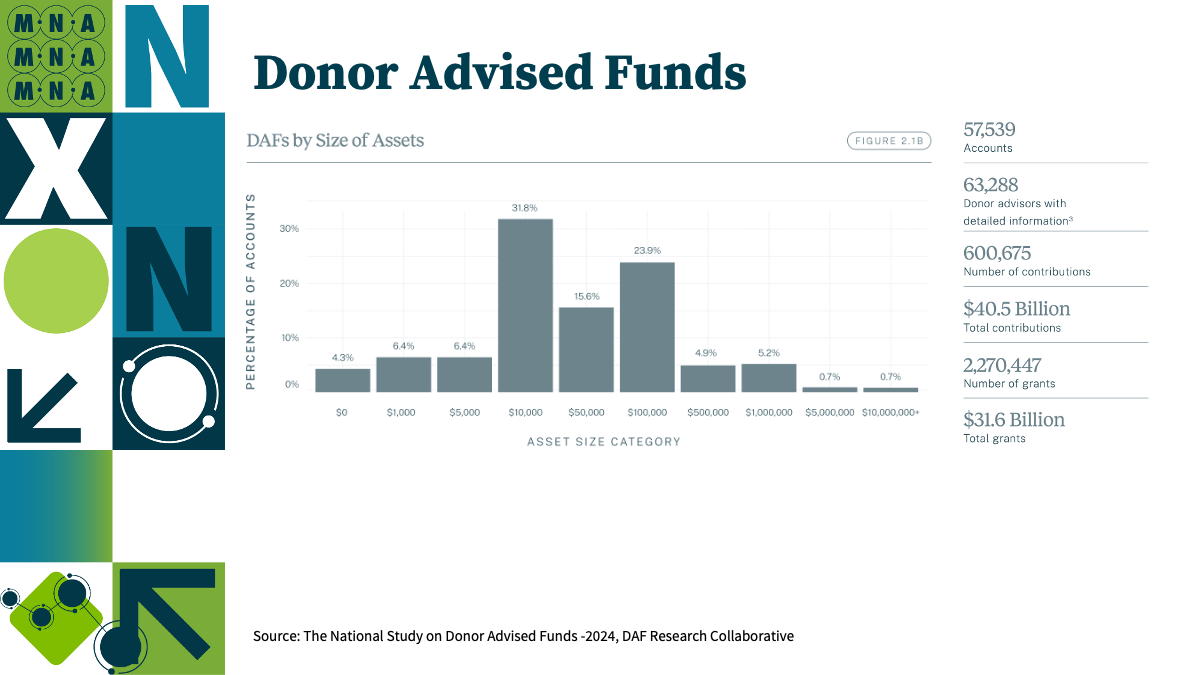

One major shift in philanthropy is the growing use of donor-advised funds (DAFs). In 2023, over $40 billion was contributed to DAFs, with $31 billion in grants distributed to nonprofits. Unlike traditional donations, DAFs allow donors to set aside charitable funds while choosing when and where to distribute them. Notably, 64% of DAF accounts hold $50,000 or less, indicating that they are increasingly being used by mid-level donors rather than just ultra-wealthy philanthropists. Understanding how to access these funds will be critical for Montana nonprofits moving forward.

MNA remains highly engaged in policy discussions at both the state and federal levels. Key legislative concerns include:

Medicaid Expansion: Ensuring continued funding for Medicaid, which supports many health-focused nonprofits.

Tax Treatment of Nonprofits: Advocacy against policies that could weaken tax exemptions for nonprofit organizations.

Federal Funding Freezes: Addressing delays in government funding, which have disrupted operations for many organizations.

With over 200 bills affecting the nonprofit sector currently in consideration, MNA encourages organizations to stay informed and participate in advocacy efforts through their online bill tracker and weekly legislative updates.

Montana’s population is undergoing significant changes, which present both challenges and opportunities for nonprofits.

Montana is one of most elderly states in the nation, with a rapidly growing population of residents aged 60 and older. By 2030, Gallatin County alone is projected to see a 30% increase in residents over 60, while other major counties, including Missoula and Yellowstone, are seeing similar trends. This shift will create increased demand for services aimed at older adults while also shrinking the available workforce.

The good news is that in-migration to Montana has brought a younger workforce. People aged 18-44 now represent the fastest-growing segment of Montana’s population. However, while out-of-state migration remains positive, in-state migration patterns are shifting, with Gallatin, Missoula, and Flathead counties experiencing net losses as residents relocate to more affordable areas.

Despite these challenges, there are bright spots for Montana nonprofits. Economic growth, population shifts, and innovative funding strategies present new opportunities.

With donor-advised funds growing rapidly, nonprofits must adapt their fundraising approaches to tap into this resource. Educating donors about how to direct DAF contributions toward their missions could help offset declines in traditional giving.

Nonprofits have the power to shape policies that impact their work. Engaging in advocacy, forming coalitions, and working closely with MNA can help ensure the sector’s voice is heard at the state and federal levels.

Adapting to workforce challenges through flexible schedules, compensation adjustments, and housing advocacy can make nonprofit jobs more sustainable and attractive. Organizations must also develop formal compensation policies to ensure equity and long-term workforce stability.

Montana’s nonprofit sector is resilient, dynamic, and essential to the state’s well-being. While challenges in workforce retention, funding, and public policy persist, opportunities exist to strengthen the sector through advocacy, strategic planning, and collaboration. By working together and staying engaged with MNA, nonprofits can continue to drive meaningful change in their communities.

Data in this report was compiled from the following sources:

Search by tag: